[From Screen to Claim] How to Integrate Insurance Coverage into Telehealth Apps

Article by Cathrine Issmaeel, Business Analyst and Igor Perov, Project Manager at Kepler Team

Telehealth applications have become increasingly popular in recent years, especially since the COVID-19 pandemic. These apps allow patients to connect with healthcare providers remotely, saving time and money while improving access to care.

However, the question of insurance coverage and integration of the health insurance software remains a challenge for many patients and providers. In this article, we'll explore the technological side of enabling patients leverage their insurance while using your telehealth platform.

So let’s take a first step to digital transformation and talk about building a connected healthcare ecosystem.

Why add insurance support to your telehealth services?

Many patients rely on health insurance to cover the cost of medical services, including telehealth. Adding insurance to the medical mobile applications enables access to a much wider audience than just working with self-paying patients.

However, combining HealthTech and InsurTech can be complex, especially when it comes to telehealth apps and platforms. For example, some insurance plans may not cover telehealth at all, or may only cover certain types of services or providers. This is why before building connected ecosystems you first need to identify all possible challenges and how to tackle them.

What roadblocks can you expect?

Adding insurance support to a telehealth app can be tricky due to a number of factors:

Insurance Billing. One of the biggest challenges faced by telemedicine platforms is the complex process of insurance billing. This process involves multiple parties, different payment rates, and various regulations that must be followed, making it difficult to navigate.

Claims submission. Insurance companies have specific requirements for how claims are submitted and processed. Failure to comply with these requirements can result in denied claims.

Different health insurance plans. In addition, there are different types of insurance plans, each with its own set of rules and requirements. Combining these plans into a telehealth app can be difficult and take a lot of time.

Integrating insurance billing into a telehealth app requires expertise in both healthcare and software development. To follow the rules and meet the requirements, it's a good idea to hire a company that knows how to make telehealth apps and can also help with insurance – like Kepler Team.

Implementing Insurance Support [Software Development Perspective]

To support insurance coverage in telehealth apps, developers need to consider several factors. One of the most important factors is data integration. Telehealth apps need to be able to access patient insurance information, including plan type, coverage details, and payment preferences.

This data may be stored in electronic health records (EHRs), insurance company portals, or other third-party services. Developers need to build secure, reliable connections to these sources and be able to pull relevant data in real-time.

Successful telehealth implementation requires a good user experience. Patients need to easily check their insurance and understand costs before or during their telehealth visits. Providers should process claims and payments within the telehealth app without switching to another system. Developers should design simple, intuitive interfaces that guide patients and providers through the insurance process, from eligibility checks to claims submissions.

Finally, developers need to consider the regulatory landscape for telehealth and insurance. Different states and countries may have different laws and regulations regarding telehealth coverage and reimbursement. Developers need to stay up-to-date with the latest requirements and ensure that their apps comply with all applicable regulations. This may involve working closely with insurance companies, EHR vendors, or other stakeholders to understand the latest standards and best practices.

How to include insurance in your app?

There are several ways to simplify the process of adding insurance support to a telehealth app and overcome its challenges:

Partner with an experienced healthcare software development company that has expertise in developing telehealth apps with insurance support. It will help you navigate insurance billing complexities and ensure compliance with regulations. A skilled company can develop custom solutions tailored to your app's needs.

Identify the specific needs of your app. Every telehealth app is different, and the insurance support will depend on the specific requirements of your app. Identify the specific features and functions that you need, and work with your development partner to develop a customized solution that meets your needs.

Stay up-to-date with the latest regulations and requirements. The healthcare industry is constantly evolving, and it's important to stay up-to-date with the latest regulations and requirements related to insurance billing. Working with a healthcare software development company can help to ensure that your app stays relevant and compliant with the latest standards.

Test the app thoroughly. After the insurance billing features are integrated into your telehealth app, it's important to test the app thoroughly to ensure that everything is working properly. Test the app with different types of insurance plans, and make sure that it's easy for patients to submit claims and for healthcare providers to receive payment.

By following these strategies, you can overcome the challenges of adding insurance support to a telehealth app and make the process less tricky. The result will be a high-quality telehealth app that makes it easier for patients to access medical care and for healthcare providers to provide the care they need.

How did we tackle health insurance integration?

With years of experience developing healthcare software, we have the expertise to develop custom solutions for integrating insurance billing into your app.

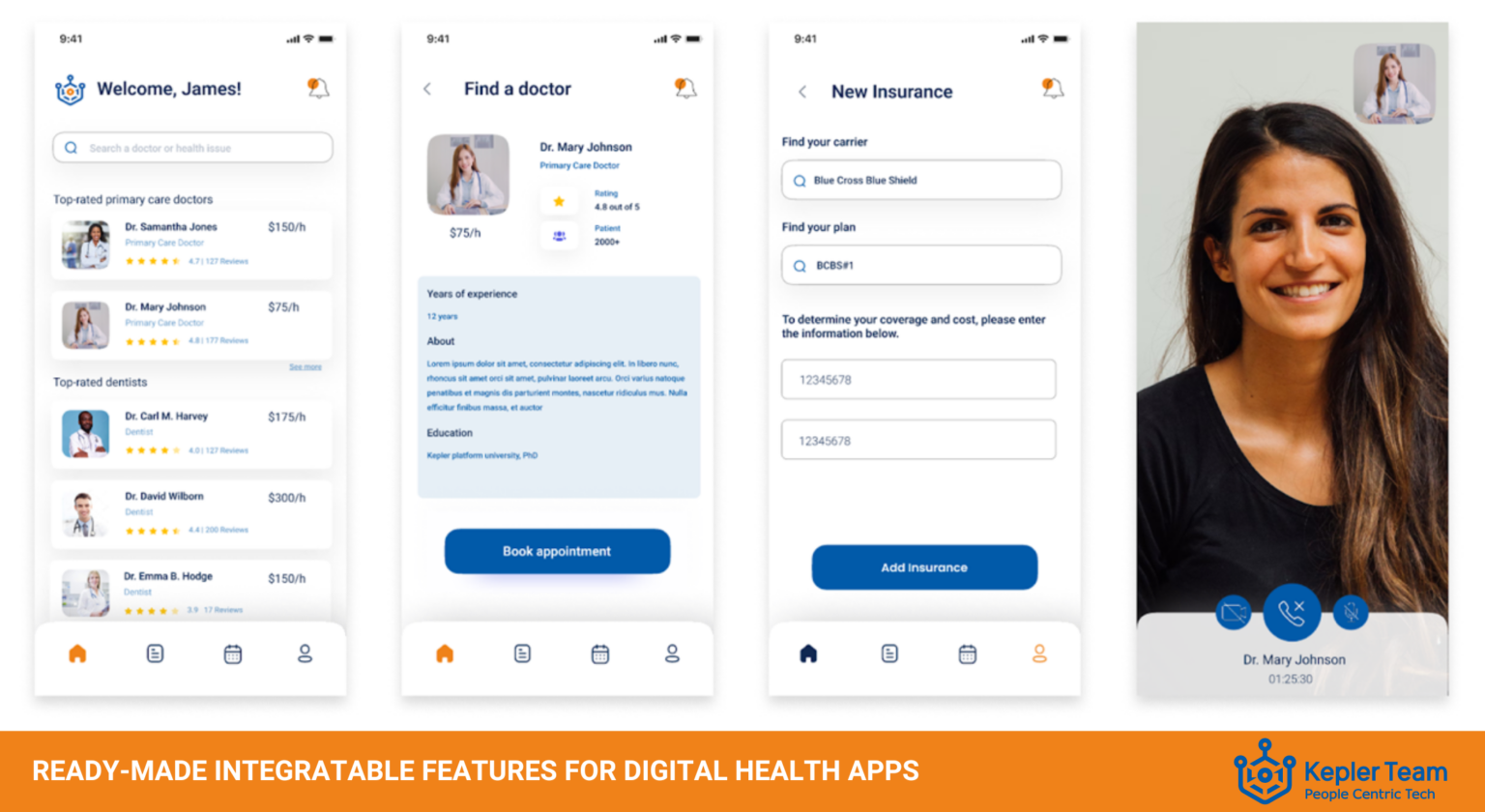

Integrating insurance into an application is a complex process that requires taking many factors into account. In our pre-build platform solution, we have considered these specifics and worked out the best UI practices.

With just a few taps, users can create online appointments with healthcare providers. Patients can choose the time and date that works best for them, without worrying about waiting in long queues. On the same page, users can choose insurance and find out the real price of the consultation according to their healthcare plan.

Additionally, we built ready-made pieces that can be easily added to any telemedicine system:

Video conferencing

Appointment scheduling

Patient management tools

Insurance integration

As telehealth applications continue to grow in popularity, it is crucial to address the challenge of insurance coverage and integration of health insurance software.

By enabling patients to leverage their insurance while using telehealth platforms, we can improve access to care and make healthcare more convenient and affordable. Building a connected healthcare ecosystem is a crucial first step towards digital transformation in the healthcare industry. With the integration of insurance coverage, telehealth apps can become even more accessible to patients and providers alike.

Reach out today – let’s talk!

If you want to develop a telehealth app with insurance support, or if you have any questions about HealthTech software development, feel free to contact Kepler Team. We’re happy to help you find the best solutions for your needs.

We’re confident in our ability to assist you!